Whilst there is an argument that information captured in prices already includes current expectations about Environmental, Social and Governance related risks or opportunities, plus governments and authorities are trying to change behaviours directly with companies and consumers, this is a rapidly evolving consideration.

Our aim is to provide guidance in this area whether it be a bespoke solution if needed, or as we find many clients are looking for:

A balance between globally diversified portfolios with the potential for positive financial returns incorporating some positive objectives and influences.

Our aim has been to try and follow the standard investment principles we believe in as much as possible, whilst looking at what investment options are available in the marketplace that support these principles, but have some focused positive objectives and influences.

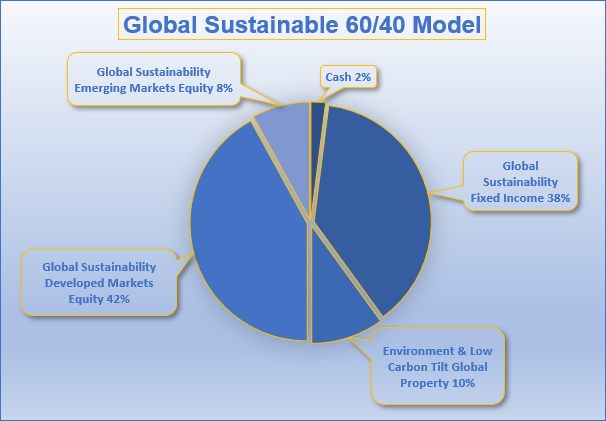

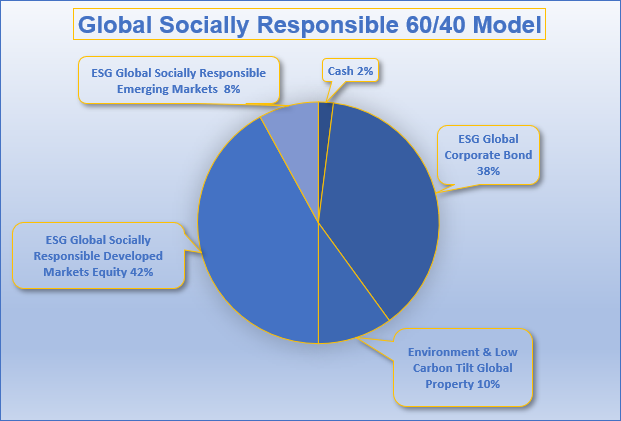

At this point we have identified two approaches that we are comfortable recommending :

We can of course build different model portfolios following the same principles to meet different investors risk levels.

Please see the following key documents to help understand each funds clear objectives in more detail and the demonstration of the influences their approaches are having.

Dimensional 12 Principles Of Sustainable Investing »

Dimensional Approach to Sustainability Investing »

Dimensional Sustainability Funds Brochure 2024 »

Dimensional Sustainability Equity Reporting »

Dimensional Sustainability Fixed Income Reporting »

Dimensional 2025 Annual Stewardship Report »

Vanguard our approach to ESG »

Vanguard UK regional brief report »

Vanguard Investment Stewardship annual report 2024 »

iShares Environment & Low Carbon Tilt Real Estate Index Fund »

Let us help you make the difficult decisions easier by building your wealth and security...Click here to talk to us.