Although most of the funds in our standard model portfolios have no specific socially responsible investing objectives or restrictions as their objective is to track the markets they invest in as closely as possibly, each of the providers do take their corporate governance seriously.

Please find below the summaries of their approach to these issues, that they have provided. Further, more detailed information is available on request.

“Vanguard represents all fund shareholders’ interests through industry advocacy, company engagement, and proxy voting.

Vanguard have a detailed annual Investment Stewardship report available which details the actions they have taken and are working to influence.”

In addition Vanguard offer some specific Socially Responsible Investing fund strategies.

Global Corporate Governance and Engagement Principles

“BlackRock’s approach to corporate governance and stewardship is detailed in our Global Corporate Governance and Engagement Principles. These high-level Principles are the framework for our more detailed, market-specific voting guidelines, all of which are published on the BlackRock website. The Principles describe our philosophy on stewardship (including how we monitor and engage with companies), our policy on voting, our integrated approach to stewardship matters and how we deal with conflicts of interest. These apply across different asset classes and products as permitted by investment strategies. BlackRock reviews our Global Corporate Governance & Engagement Principles annually and updates them as necessary to reflect in market standards, evolving governance practice and insights gained from engagement over the prior year. Our Global Corporate Governance & Engagement Principles available on our website at:” link »

Fidelity outsource the management of the World Index fund we use to Geode Capital Management LLC in Boston, America.

“Geode excels at providing customized solutions to meet investors’ needs. We recognize that Environmental, Social and Governance (ESG) factors may have an impact on a portfolio’s risk and return profile, and that clients may also have other motivations for ESG investing. Geode believes it can best address these preferences through client-specific mandates that are customized to each investor’s unique preferences and circumstances.

Geode’s priority is fulfilling its fiduciary duty to its clients. Geode manages funds and accounts with the overriding goal of providing the greatest possible return to investors consistent with the investment guidelines for each fund and account. By becoming a Principle for Responsible Investing (PRI) signatory, Geode has committed, where consistent with its fiduciary duty to clients and each client’s mandate, to the following principles:

The goal of our approach to corporate governance is to effectively use engagement and voting to protect and enhance shareholder value. Stewardship is an important element of our investment process and a part of our fiduciary duty. Our voting policy and our continued diligence and review of company governance practices attest to our commitment. We believe that asset prices in competitive markets reflect the aggregate expectations of market participants. Relevant information embedded in prices includes financial data and non-financial data, such as the governance practices of a firm. As governance practices are already priced into a security, we should not necessarily avoid investing in firms based on their governance practices. Rather, we believe that, once an investment has taken place, shareholders and investment managers should work to improve poor governance practices.

Valuation theory suggests that the current market value of a company is equal to the value of its net assets plus the net present value of its future earnings. Sound governance practices can protect existing assets or increase expected earnings by, for example, avoiding expenses and transfers of wealth that are not in the interests of shareholders.

The Corporate Governance Group (the Group) is responsible for the implementation of our proxy voting policy and oversees day-to-day operations. The Group is composed of both Dimensional’s investment professionals and its dedicated corporate governance personnel. Besides voting, Dimensional may engage with portfolio companies directly to understand their perspective on a particular topic or provide our point of view. Engagement can take the form of meetings and calls with board directors and company executives and of written letters.

Consistent with how we manage portfolios, Dimensional employs a robust, cost-effective, and disciplined approach to voting. We systematically take into account costs and expected benefits on a portfolio-by-portfolio basis.4 Costs associated with voting include custody fees and voting agent fees. We are mindful of those costs because they may create a performance drag on our portfolios. The benefit associated with voting is to encourage stronger corporate governance practices. That benefit is a function of how much the company represents in each portfolio as well as of the percentage of the company’s outstanding voting shares held by the portfolio. If the expected benefit is not significant, but voting would generate substantial costs, we may abstain from voting. Hence, we exercise voting rights to the extent that it makes economic sense for our clients.

To access our proxy voting guidelines, please visit this link

This outlines our approach to corporate governance and a link that gives further details on how we implement this across our fund range.

Index investor, active owner

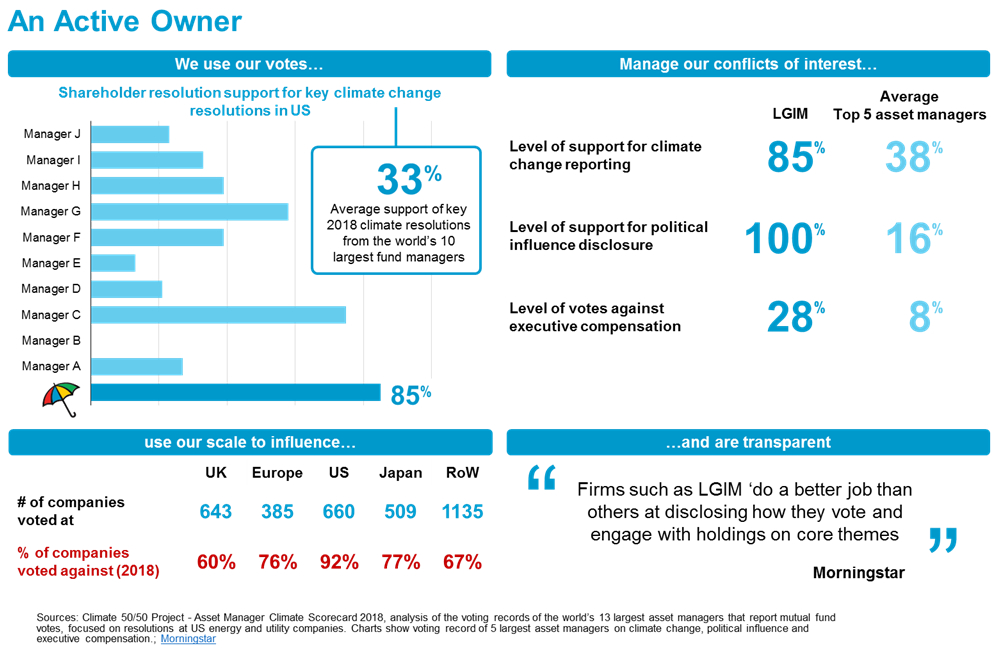

Being one of the world’s largest asset managers with a long history of corporate engagement on the most material long-term issues, LGIM has the scale and ability to make a real, positive impact on the companies in which we invest and on society as a whole. We share this objective – made far more attainable by on-going improvements in ESG data – with a growing number of clients. We believe that Responsible investing cannot be just a box-ticking exercise. So from the votes cast by our industry-leading Corporate Governance team to the investment processes deployed in our funds, we continue to take steps to embed the principles of responsible investing across our entire business – and act on them.

We believe that well-governed companies that manage all stakeholders, including the environment and society, are more likely to deliver sustainable long-term returns. We view the consideration of ESG issues as part of risk management, and therefore part of our fiduciary duty. We recognise that companies are intrinsically linked to the economies and societies in which they operate and we therefore believe that investors have a responsibility to the market as a whole. Our ultimate goal is to protect and enhance the investment returns for the benefit of our clients’ assets. Active ownership forms a key part of how we conduct responsible investing, as we feel it is incumbent upon us to take our stewardship responsibilities seriously, not least because of our size. This is reflected in the following activity:

Active ownership

Active ownership forms a key part of how we conduct responsible investing, as we feel it is incumbent upon us to take our stewardship responsibilities seriously, not least because of our size. It is the cornerstone of how we approach responsible investing across our index strategies; we remain committed to engaging and voting on holdings across our entire book, on behalf of our clients. Our policies reflect our approach and expectations on the topics we believe are essential for an effective governance framework and for building a sustainable business model.

Our corporate governance and responsible investment policies, voting reports and corporate governance annual reports are available on our website.

Regular reporting

LGIM’s Corporate Governance team provides the below periodical reporting to large institutional investors. However, we would be happy to discuss additional reporting formats, should these be required.

Annual report

Active ownership means working to bring about real, positive change to create sustainable value for our clients. Our annual Corporate Governance report details how we achieved this in 2018.

Quarterly ESG Impact report

On a quarterly basis we provide a standalone document providing detailed, named case studies of the voting and engagement activities undertaken and/or concluded globally.

Monthly voting reports

We publicly disclose our votes for the major geographies. We can provide monthly voting reports for clients to use in their own reporting.

Please note that the Blackrock IShares Environment and Low Carbon Tilt Real Estate Index Fund used in our current model portfolios does target some environmental benefit. Please see the following link for their briefing note on their approach.

Let us help you make the difficult decisions easier by building your wealth and security...Click here to talk to us.