Since Chancellor Kwasi Kwarteng delivered his "mini budget and Growth Plan" a few weeks ago, UK markets and sterling have experienced alarming volatility as concerns intensify over the prospect of a surge in government borrowing in order to fund the tax cuts. Investor confidence has understandably been shaken and impacted. The Bank of England has intervened in the UK government debt market, to shore up the economy and provide reassurance.

Recent announcements from the Bank of England suggest that the UK economy may already be in recession. Inflation driven by the soaring global energy costs resulting from the Russian invasion of Ukraine is now in the region of 10% and is expected to rise further. The value of the FTSE 100 share index has fallen by around 7.2% since mid-August to 29th September 2022*.

Meanwhile, the value of the pound fell to a record low against the dollar in response to Chancellor Kwasi Kwarteng's mini budget statement on 23rd September. The weak pound is likely to make imports of goods and services more expensive, further fuelling inflation.

As the current economic crises continues to make headlines investors may naturally be concerned about the impact on the value of their investments and may worry about what action they should be taking.

Timing of Investments

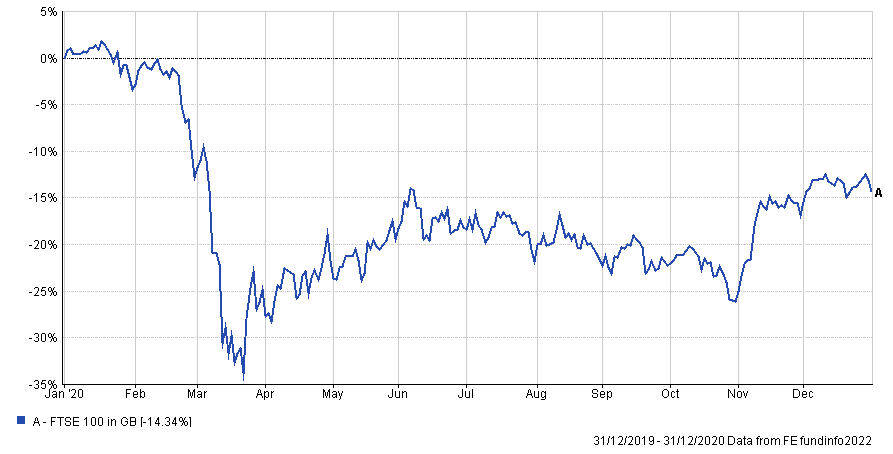

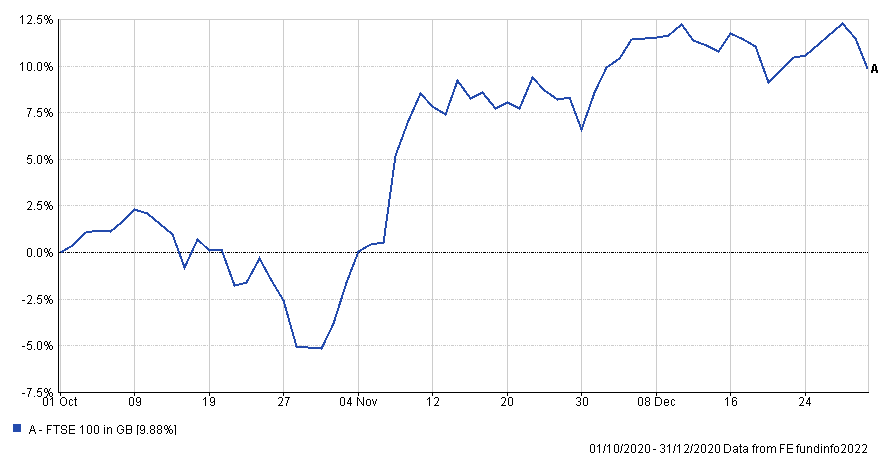

Firstly, it is important to remember that investments should always be viewed as medium to long-term holdings. Markets will invariably react and fall in value in relation to short-term uncertainty and bad news, as was the case in early 2020 at the start of the Covid pandemic and the announcement of lockdown. Markets fell dramatically during March 2020, but later in 2020 when the promise of a vaccine started to emerge the FTSE 100 index rose by around 10%* during the final quarter of the year, as shown on the charts below. Panicked investors selling out of their investments in the Spring would have likely to have been harder hit by missing out on this upturn.

Investors should think carefully before making a decision about disinvesting in response to short term volatility. By doing so, you could realise losses in your portfolios or sell assets at a point when the values have fallen, and you could miss out on a proportion of any future recovery if you decide to re-enter stock market-based investments later, perhaps when a degree of confidence has returned.

Financial advisers select investment portfolios for clients to an agreed risk level. These portfolios will invariably contain a blended range of different asset classes to diversify risk and deliver investment returns over the long-term. Equities have proven in the past to be a good insurance against inflation over the longer term as they generally deliver returns over and above inflation. The opposite is true of cash which generally is eroded in value by inflation over the longer-term. This is an important consideration as inflation continues to rise. However, cash or other lower risk assets in a portfolio are important to help offset the effect of short-term volatility. Therefore, it is important to hold a blend of asset classes within a portfolio suitable for both your investment objectives and the amount of investment risk you are prepared to take.

Bond markets, in particular, have suffered a big impact through this year due to the global combination of elevated inflation concerns coupled with rising interest rates. For central banks the concern is that inflation becomes embedded and so they are tightening policy, relatively aggressively, to slow the economies and bring inflation and inflation expectations under control. This policy of raising the general level of interest across an economy impacts many assets, but in particular fixed interest securities, as it results in their capital values falling as their yields have to adjust closer to the prevailing general level of interest rates across an economy.

What is a little unusual is how much the traditionally viewed lower risk assets such as bonds and gilts have fallen in value this year. This is largely down to the unexpected speed of the inflation and interest rises globally. UK Gilts and index linked gilts have also been hit by investor concerns about UK debt and its current policy, as detailed earlier.

Rebalancing - why

You may wonder why, during these times of heightened volatility, we have just rebalanced our portfolios and, in particular, you might ask why have we bought more of some assets that have fallen in value this year?

Over time investments asset values always have and always will fluctuate, which means the portfolio moves away from the intended diversified allocation designed for your agreed risk profile. In order that your portfolio continues to match the recommended and intended allocation, it needs to be rebalanced in line with the agreed mix.

To avoid any temptation of trying to time the market in constantly choosing when to do this, our portfolios are automatically rebalanced on fixed dates on 6th April and 6th October each year (or the next working day if this falls on a weekend or public holiday).

This disciplined approach helps maintain the diversification required and takes the inevitable emotional risks out of getting the timing wrong (or the risk of not doing it at all) and not having the diversification desired.

If the price of a certain asset(s) is lower at the time of a rebalance, more units are purchased than would previously have been the case. Eventually, the price of these units will increase & the overall value of your portfolio will rise.

Remember though, the main reason to rebalance is to maintain the desired and agreed level of diversification & subsequent investment risk.

Feelings

We understand that it is difficult when you are watching the value of your accounts falling. We know it can be difficult to keep emotions in check when there is so much negative economic and geopolitical news being reported, but market volatility is normal. Over the last few years, it does feel like it has been one crisis in the world, then another, with little respite.

Part of our job is to help steer you through these troubled waters. By holding a well-diversified, risk-appropriate portfolio and staying focused on your long-term objectives, goals and aspirations, you are inevitably well equipped to get through such periods and participate in the recovery when it arrives.

In summary: -

- Financial markets have had a difficult year thus far, with returns on typically "lower risk" fixed income securities bearing the brunt of the impact due to rising inflation and interest rates. That also not helped by global geopolitical issues.

- Inflation is possibly showing signs of moderating, and there is some evidence of a slowdown in economic activity which will warrant a moderation of policy tightening, in time.

- Valuations on many asset classes are now much cheaper on conventional metrics/ estimates, and so provide investors with a strong chance of generating good risk adjusted returns over the medium-to-longer term, accepting still some short-term disruption.

We're here for you

Hopefully these notes will help you to gain a better understanding of current events. If you are still concerned about the value of your investments and the impact of the economic crisis, then please talk to us.

If you are worried about making new lump-sum investments in the current climate than phased investment may be a consideration, where capital can be invested in smaller equal instalments over a longer period. This strategy could help mitigate the risk of timing the markets but is not guaranteed.

However concerning market fluctuations may be, remember that together we have worked hard to formulate a financial plan which is in line with your personal requirements. Having a well-thought-out strategy helps you deal with unexpected events and means you can remain calm when markets become turbulent. Investors who maintain a long-term outlook may avoid losing out on any future recovery.

We want to reassure you that we're here for you; we are monitoring developments and are here to provide help and support. Your best interests remain our priority.

Please do not hesitate to get in touch with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.